Alok asked earlier about what change in behaviour we’re seeing among VCs. My own sense is that VCs in India are much more cautious than VCs in, say, the US. “No” is always a safe answer. Of course, the “venture” or “risk” part of “Venture Capital” is then drastically downplayed. Nowhere is this more true than in times like these. I have not attempted to gather much data on this impression yet specifically for the Indian market, but I would be surprised to be proved wrong.

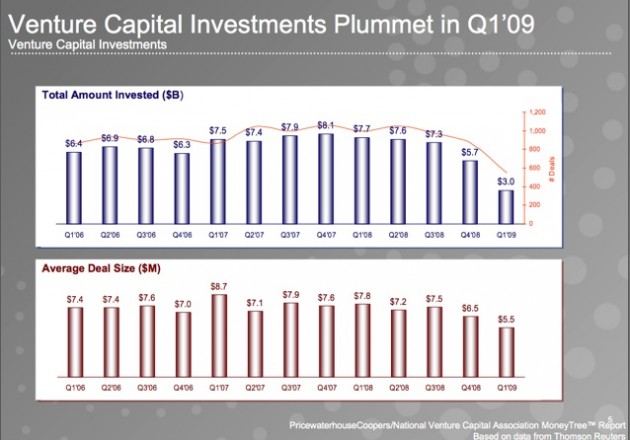

Meanwhile, in the US, investments have fallen off a cliff. A post in TechCrunch details just how bad it has been so far this year:

And make no mistake—it’s a steep drop. Venture funding fell by 50% nationally from the first quarter in 2008 to the first quarter of 2009, totaling to $3.9 billion, according to Dow Jones Venture Source. That’s the lowest total since 1998. PricewaterhouseCoopers and the National Venture Capital Association had it falling farther to $3 billion.

Information technology investments fell 53% year-over-year to $1.7 billion—the lowest since 1997, and the lowest volume of deals since 1995. And clean tech? Well so much for that being the future of the U.S. economy: It fell by 74% to a paltry $117 million.

The author also believes that this isn’t just about the recession, and that the VC industry was overdue for a shakeup.

Returns, on the other hand, did go down. And they never really got back up, given the amount invested. But the industry is graded on a ten-year time horizon so that didn’t matter much. Once returns from 1999 and 2000 fall off that scale, it will. Returns will look at or below the S&P 500 for what is supposed to be a niche, high-risk/high-reward asset class. It takes forever to correct because fund cylces are so long, and the asset class is so illiquid. But it won’t go uncorrected, and the witching hour is getting close.

What does this have to do with money going out to startups? VCs are scared for the first time in a long time. There’s no obvious high growth sector of the tech economy, and their investors are hit in nearly every nook and cranny of their portfolios. They’re not sure how to do their jobs anymore when nothing can go public and acquisitions are few and far between.

I suspect, even though the VC industry is so young in India, that the reverberations will be felt here as well.

What is your feel? Any pointers to up to date data for India?

- Mary Meeker’s 2014 Internet Trends report - May 28, 2014

- Andreessen-Horowitz raises $1.5B for its new fund - February 1, 2012

- WestBridge launches India “evergreen” fund - November 15, 2011

I have a feeling that in India VCs will never succeed as there is greed in the promoters as well as investors.

With VC’s it is always one way street, they get a plenty and if the concept is hit, they make a killing before IPO.

Also same idea presented by 2 different people of similar kind, gets valued differently.

If you have the right contact, you might get the “next best idea” for you to develop (your skill) usurping from the actual owner…

It was cautioned on this board months ago that the VC model is broken and is going to face its toughest period soon.

Reasons:

1. Limited Partners have either no money or have lost so much elsewhere that the % allocation to VC pool means no new money is to be allocated. That’s the cliff you see in the chart.

2. VCs as a whole have failed to show returns and their fund management fees are horrendously expensive compared to their overall performance. If you exclude the top 10 VCs, the median of all others will likely come near 10% (or below, if you exclude fees), which is the same as long term return on stocks or index funds. Among hedgies, PEs, and VCs, VCs managed to keep their investment system opaque for the longest but gradually the glossy pitches and portfolio company health are being scrutinized more sharply.

VC ecosystem and # VCs in India may be more than in 2001, but that means nothing when evaluating performance. Performance is returns. The crop of 2005-era VCs (especially many of the Valley fund branches here) is yet to complete its 7-year harvest but the intermediate picture does not look encouraging. More funds have flowed than 99-01 but there have been more business models as well. Its not that the funds flowed necessarily to smarter business models. Bottomline: When the dust settles, the statistical impact of the better ‘ecosystem’ on returns may still be negligible.

Nice post Udhay. Here’s the latest VC investment data tracked by my co. Venture Intelligence: In Q1 ’09, VC firms invested $44 million over just 9 deals. The amount invested during the period was lower compared to the immediate previous quarter (which had witnessed $91 million being invested across 18 deals) as well the same quarter in 2008 ($226 million invested across 33 deals).

The largest investment reported during Q1 2009 was the $12 million raised by US- and India-based chip design firm Si2 Microsystems from Ventureast and Jafco Asia. Information Technology and IT-Enabled Services (IT & ITES) companies accounted for five out of the nine investments during Q1 ‘09. Interestingly, 2/3rds of the VC investments during Q1 ‘09 were in the early stage segment.

——

Data apart, my conviction is that the VC ecosystem in India is in far better shape now than it was at the end of the 2001 downturn. While there have been several discussions on how the venture model in the US is “broken” – given the poor returns delivered in the recent years by most venture funds outside of the “top quartile” – I believe it would be a mistake to club VC investments in India with those in the US.

Venture Capital was effectively dead in India between 2001-02 and 2005-06. And, in its new avatar, VC in India has been far more “slow and steady” and has newer characteristics that lead me to believe that it will be more sustainable once the dust settles on the global financial mess. A great +ve is the fact that former entrepreneurs – like Alok Mittal, Sanjeev Agarwal, Ashish Gupta, Vinod Dham and Vani Kola – are among the active VCs in India today. Also, several of the funds are “India-dedicated” – ie, they can’t go elsewhere, if India is no longer the flavor-of-the-season. Another great +ve is the rapid development of the “feeder channels” for VC – angel networks (like IAN, Mumbai Angels, Chennai Fund, etc.) as well as seed funds like Accel Partners, Ventureast and Seed Fund – which were non-existent in 2001.

Cheers

VC is a rather new phenomenon in India. Traditionally people start pvt limited companies and then take it to public if they need to raise more capital or reach. One way to look at the number of new issues. Edserv is the only company who could muster courage to go public in 2009. Another data point is the getting hold of list of private limited ventures. Not all Pvt Limited ventures go to VC. Many get support from state level industry development authorities (or perhaps connections at higher places).

The number of people who have quit senior positions to start on their own in India is an indicator that they believe starting in the downturn will give an advantage when things start to look up.